Market Risk Management

Market risk refers to the risk of losses in the bank's portfolio due to changes in equity prices, interest rates, credit spreads, foreign-exchange rates, commodity prices, and other indicators influenced by the performance of the financial markets. Sources of market risk include political turmoil, changes in interest rates, natural disasters and terrorist attacks.

The ultimate purpose of managing the risk is to ensure that the bank has enough capital to guard itself against the risks if the unthinkable crisis were to hit a bank. To calculate the required capital, we need to understand the risks that a bank is carrying. This particular topic only covers Market Risk among many other risks like Credit, Operational, Liquidity risks, etc. that the bank would have to hold the capital against.

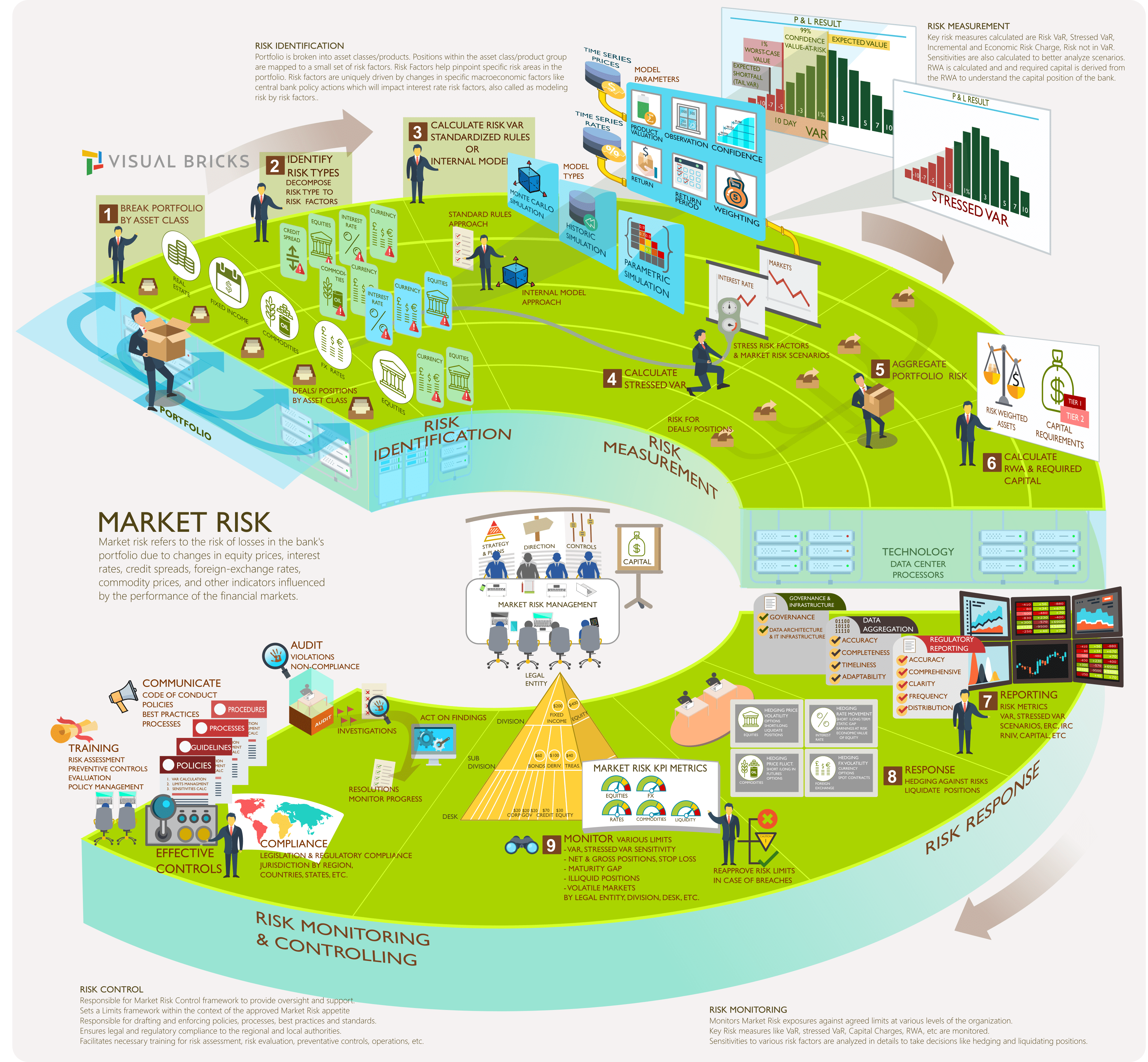

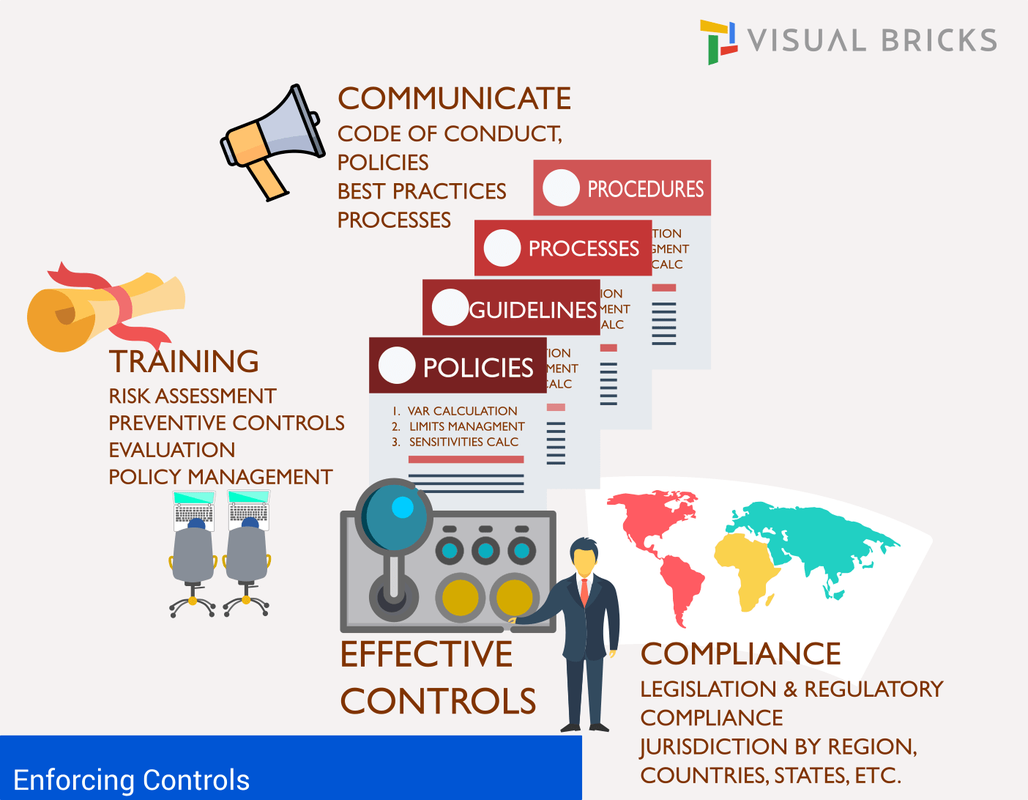

So how is the market risk identified, measured, managed and monitored? The illustration below provides a birds-eye view of the market risk management.

The ultimate purpose of managing the risk is to ensure that the bank has enough capital to guard itself against the risks if the unthinkable crisis were to hit a bank. To calculate the required capital, we need to understand the risks that a bank is carrying. This particular topic only covers Market Risk among many other risks like Credit, Operational, Liquidity risks, etc. that the bank would have to hold the capital against.

So how is the market risk identified, measured, managed and monitored? The illustration below provides a birds-eye view of the market risk management.

For trading books, VaR, stressed VaR and incremental risk models are mostly used while interest rate risk model is used for the interest risk in the banking book.

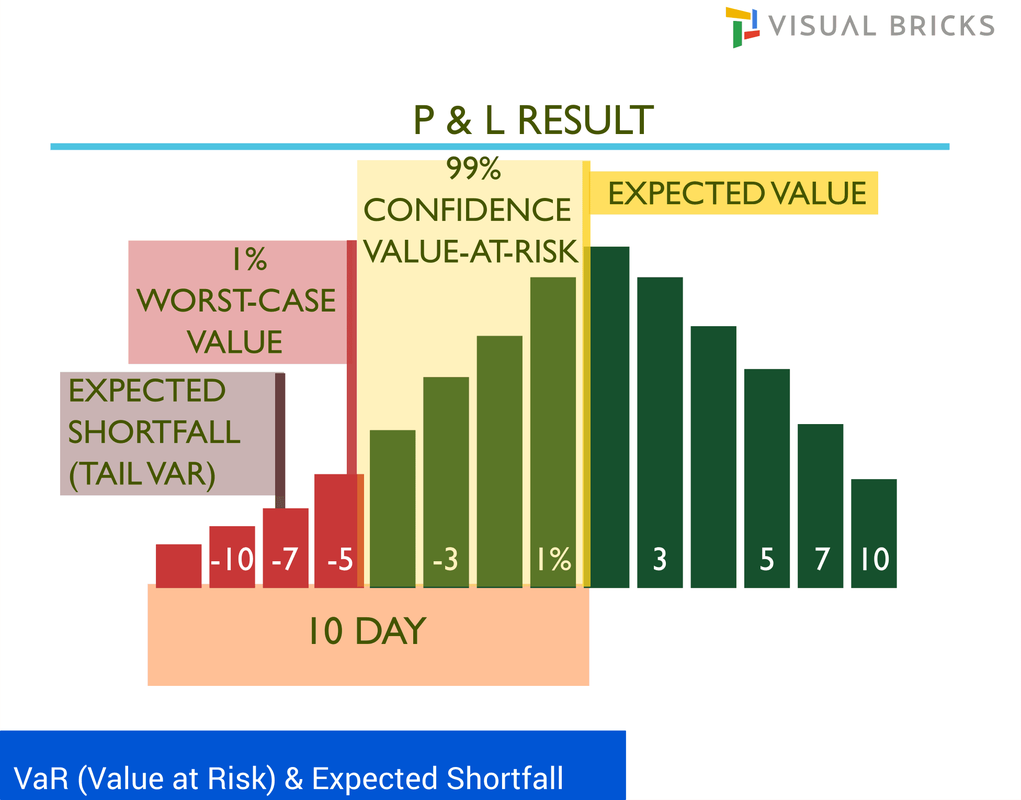

Expected Shortfall

One of the biggest drawbacks of VaR is that it tells the amount we expect to lose more than the VaR but does not tell the how much more amount of loss that can be (in the remaining 1% of occasions if VaR calculated to 99% confidence). Expected Shortfall (ES) or Expected Tail Loss or tail VaR tries to address this deficiency of VaR. ES is a better risk measure which provides an expected loss if the tail event occurs. ETL is sub-additive while VaR is not which is a very favorable properly when analyzing risk and its sub parts. Sub-additivity is an important property since the risk of the portfolio should always be less of equal to the sum of risk of its components. Addition sub-portfolios together should not increase risk.

Risk Management is always focused on the left hand tail that corresponds to the high negative P/L values or big losses.

Expected Shortfall

One of the biggest drawbacks of VaR is that it tells the amount we expect to lose more than the VaR but does not tell the how much more amount of loss that can be (in the remaining 1% of occasions if VaR calculated to 99% confidence). Expected Shortfall (ES) or Expected Tail Loss or tail VaR tries to address this deficiency of VaR. ES is a better risk measure which provides an expected loss if the tail event occurs. ETL is sub-additive while VaR is not which is a very favorable properly when analyzing risk and its sub parts. Sub-additivity is an important property since the risk of the portfolio should always be less of equal to the sum of risk of its components. Addition sub-portfolios together should not increase risk.

Risk Management is always focused on the left hand tail that corresponds to the high negative P/L values or big losses.

|

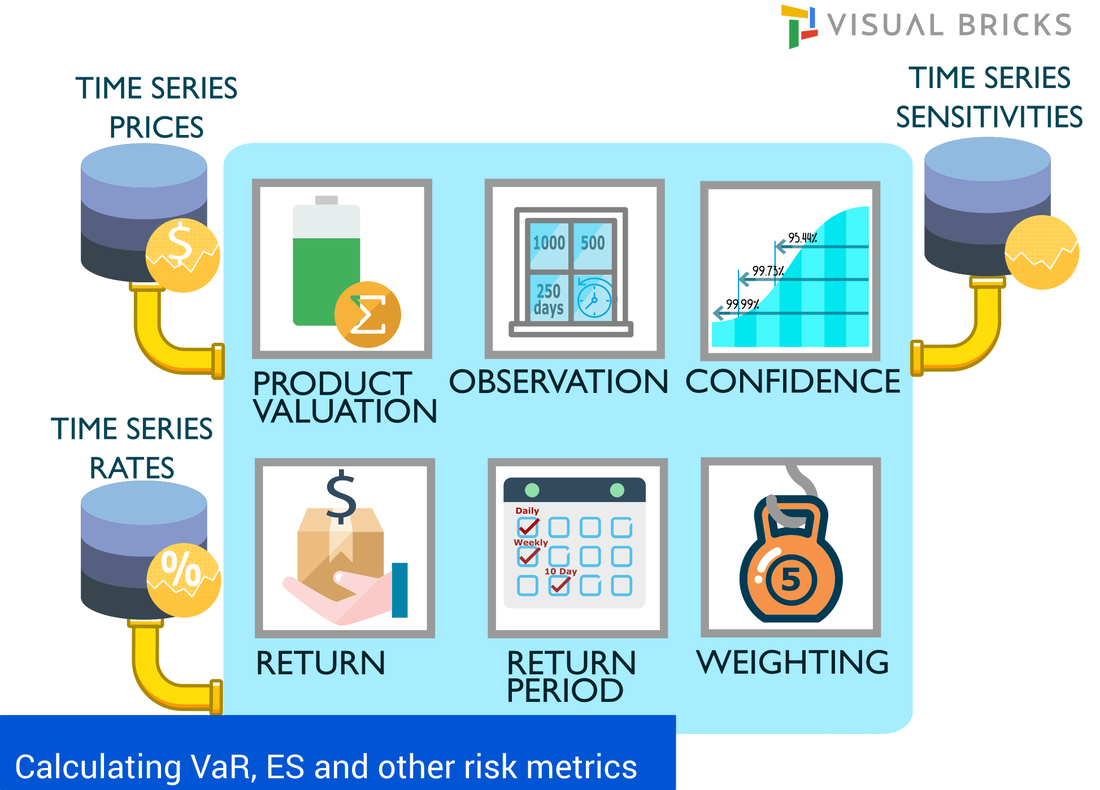

Calculating Risk Measures

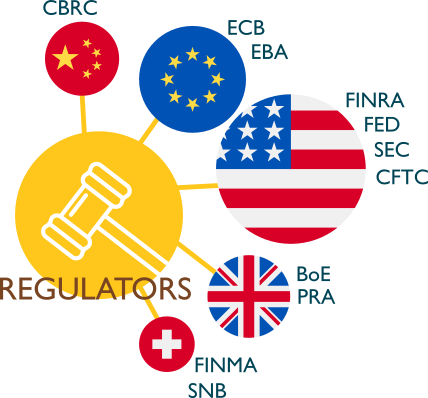

Calculation of VaR is driven by country specific regulatory requirements, it can also be driven by region and product specific regulators. A segment can have its own regulator depending on the size of the market. USA has multiple regulators governing the different kind of markets while some countries can have a regulator overlooking everything. |

|

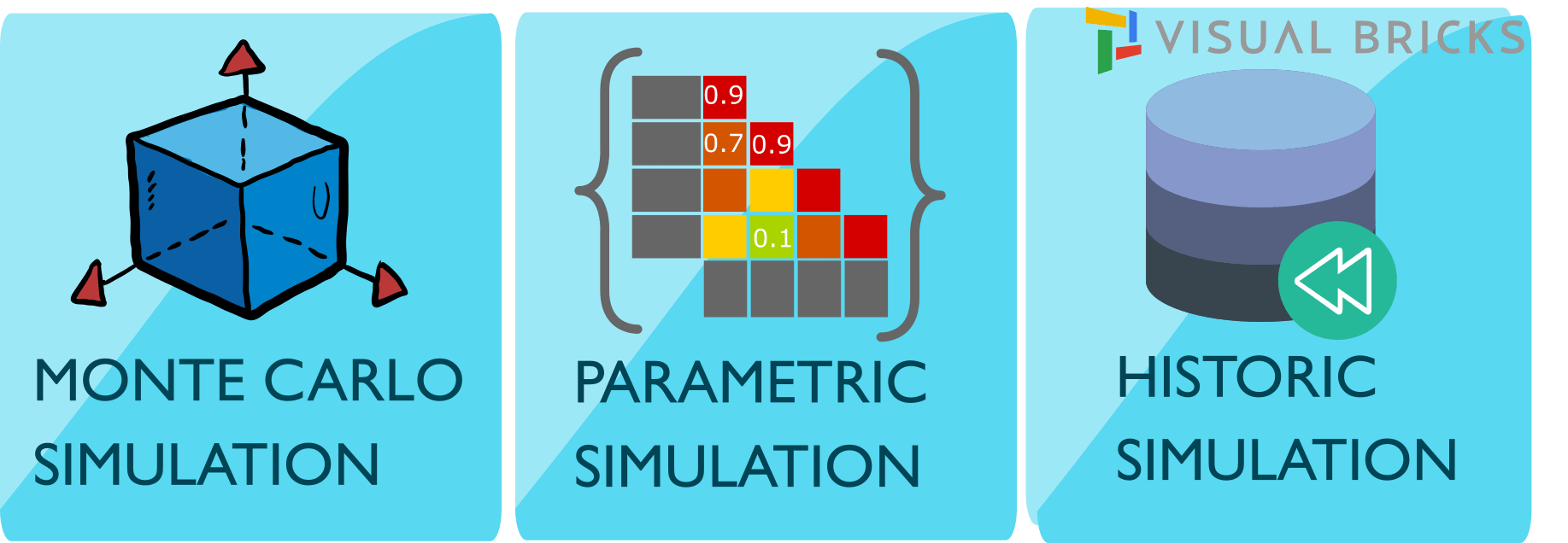

Calculation methodologies

Historic Simulation, Variance Co-Variance/parametric and Monte-Carlo simulation are commonly used methodologies to produce VaR numbers. In the Historical simulation approach, the distribution is made of scenarios sampled from history. Marginal VaR describes change in total var resulting from 1 dollar change of the component value (positions of different instruments) Incremental VaR is a change in VaR due to new position added to a portfolio. Component VaR is often used by risk management as it is additive i.e the component VaRs add up to the portfolio VaR. |

|

Var Calculation Inputs

|

|

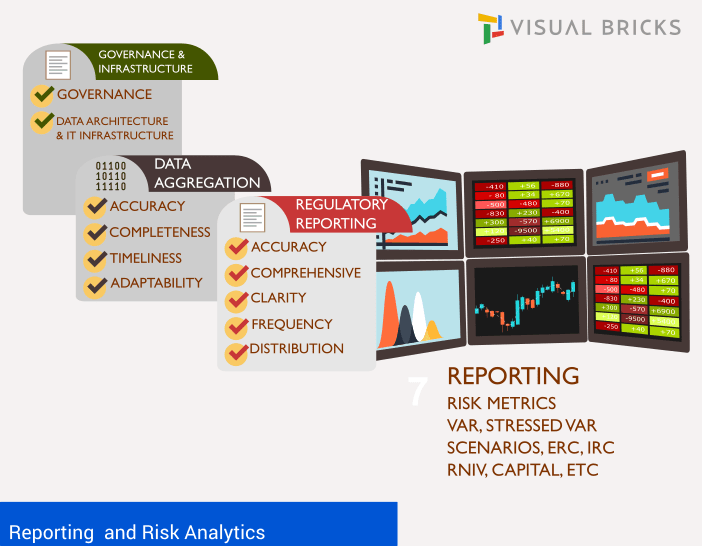

Reporting and Analytics

The reporting and analytics systems must be comprehensive covering: - Overarching Governance structure, supervisory workflows - Risk Data Aggregation across Organization levels, Regions and Lines of Business - Provide granularity across spectrum of the organization from leadership to management to support - Report on all key Risk Indicators, highlight areas of concern and emerging threats and opportunities - Provide analytical tools to monitor changes and transparency to lowest levels of data - Compliance to the Legal and Regulatory requirements The IT infrastructure must be scalable to support these capabilities. It must adhere to the principles for effective risk data aggregation and risk reporting by Basel Committee on Banking Supervision. -Governance & IT infrastructure -Accuracy and Integrity, Completeness, Timeliness and Adaptability - Comprehensiveness, Clarity and usefulness, Frequency and Distribution Refer to BCBS 239 principles here: www.bis.org/publ/bcbs239.pdf |

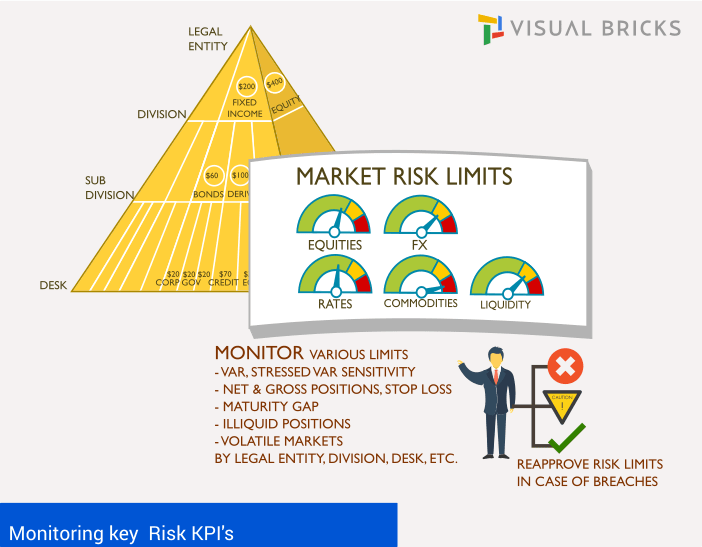

Monitoring Risk

Banks monitor various types of limits to reduce the risk exposure. Limits are authorized by the board and the senior risk management committees. They are allocated across the organization by risk types, business lines from top to bottom, regions, legal entities and countries. The risk organization reports and monitors the compliance against the approved limits. The types of limits used are:

|