|

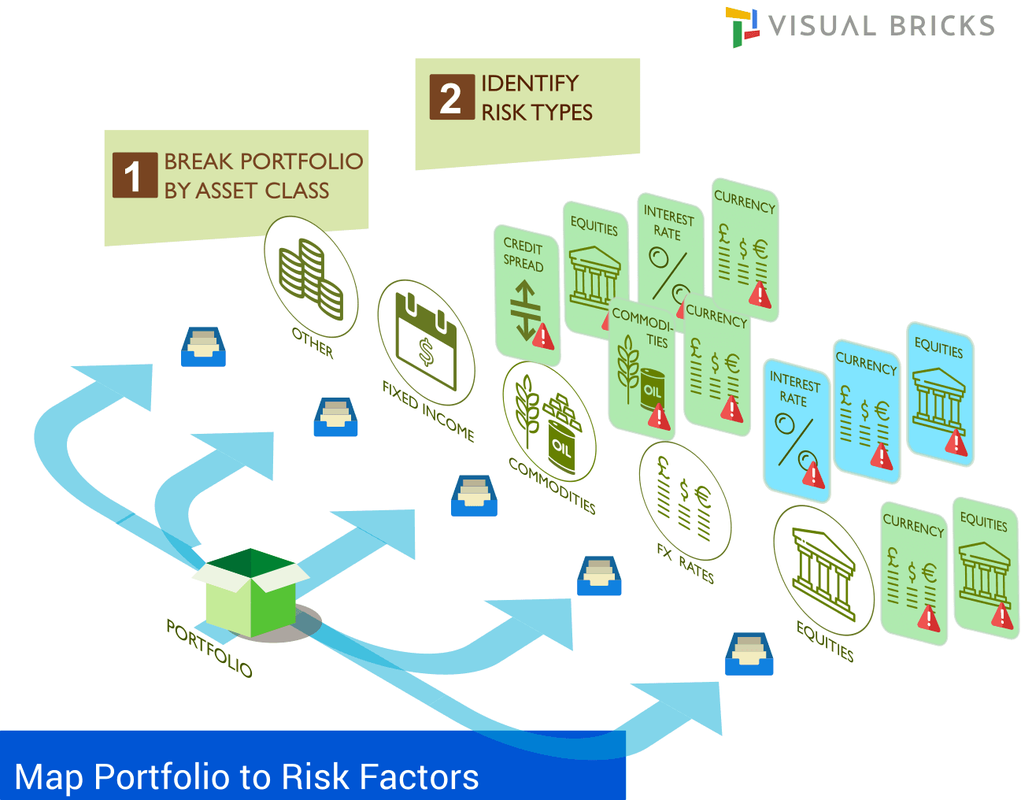

Risk identification begins with identifying risk factors in the portfolio as a first step. Positions are mapped to a small set of risk factors which is called as risk factor mapping. It depends on the number and type of instruments within the portfolio.

Risk Factors help pinpoint specific risk areas in the portfolio. Risk factors are uniquely driven by changes in specific macroeconomic factors like central bank policy actions which will impact interest rate risk factors. This is also called as modeling risk by risk factors. Large number of deals are mapped to a smaller set of risk factors reducing the computing time for risk simulations. As an example in the illustration, Interest Rate, Currency and Equites risk factors are mapped for all the rates positions. If a portfolio contains 1000 Rates deals all of them can be mapped to the above 3 risk factors. Comparable assets can also be used as proxy assets for modeling in cases where enough historical data is not available for positions or some OTC instrument that has no previous history. See more details on MARKET RISK.

0 Comments

|

Archives

March 2017

Categories |

RSS Feed

RSS Feed